Mileagewise - Reconstructing Mileage Logs Can Be Fun For Everyone

Table of ContentsSome Known Details About Mileagewise - Reconstructing Mileage Logs Excitement About Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsFascination About Mileagewise - Reconstructing Mileage LogsThe Buzz on Mileagewise - Reconstructing Mileage LogsGetting My Mileagewise - Reconstructing Mileage Logs To WorkMore About Mileagewise - Reconstructing Mileage Logs

Timeero's Shortest Distance function recommends the fastest driving course to your workers' location. This feature enhances efficiency and adds to cost savings, making it a vital asset for businesses with a mobile workforce. Timeero's Suggested Route attribute even more increases responsibility and efficiency. Employees can contrast the suggested course with the real path taken.Such a technique to reporting and compliance streamlines the commonly complex task of taking care of mileage expenses. There are many benefits related to utilizing Timeero to monitor gas mileage. Allow's take a look at several of the application's most remarkable functions. With a relied on gas mileage tracking tool, like Timeero there is no demand to stress concerning accidentally leaving out a date or item of details on timesheets when tax obligation time comes.

The smart Trick of Mileagewise - Reconstructing Mileage Logs That Nobody is Discussing

With these devices in operation, there will be no under-the-radar detours to enhance your reimbursement expenses. Timestamps can be discovered on each gas mileage entry, enhancing reliability. These additional confirmation procedures will maintain the internal revenue service from having a reason to object your gas mileage records. With accurate mileage monitoring innovation, your employees don't have to make harsh mileage price quotes or also bother with gas mileage cost tracking.

For instance, if an employee drove 20,000 miles and 10,000 miles are business-related, you can create off 50% of all automobile costs. You will certainly require to continue tracking mileage for job also if you're using the actual cost method. Keeping gas mileage documents is the only method to different organization and individual miles and supply the proof to the IRS

Most mileage trackers let you log your journeys manually while computing the range and compensation quantities for you. Numerous likewise included real-time trip monitoring - you require to start the application at the beginning of your journey and quit it when you reach your final destination. These apps log your start and end addresses, and time stamps, together with the total range and compensation quantity.

6 Easy Facts About Mileagewise - Reconstructing Mileage Logs Shown

One of the questions that The IRS states that car costs can be thought about as an "normal and essential" expense in the training course of doing service. This includes prices such as fuel, upkeep, insurance policy, and the vehicle's depreciation. For these costs to be thought about deductible, the car must be used for business functions.

8 Simple Techniques For Mileagewise - Reconstructing Mileage Logs

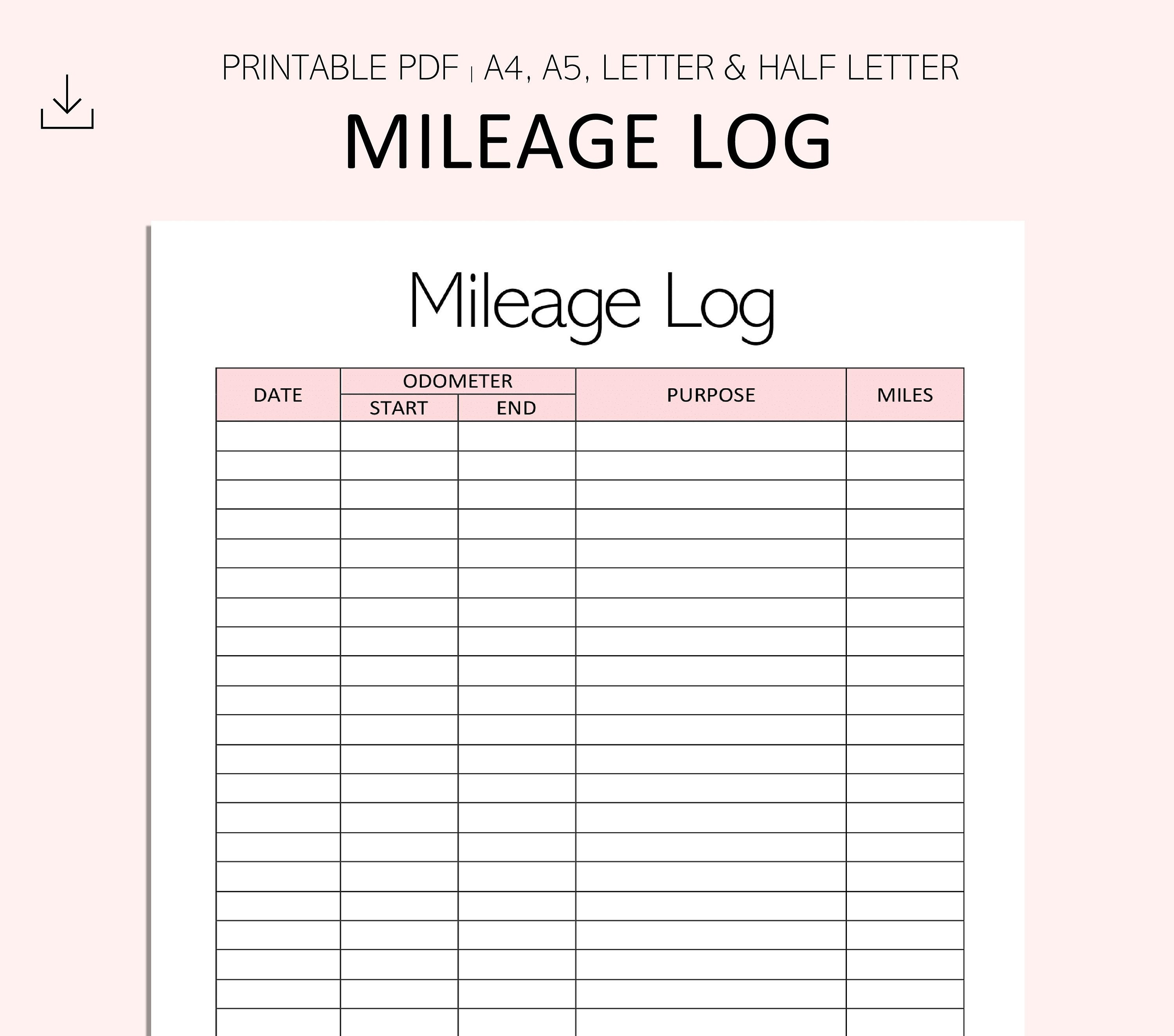

Begin by videotaping your vehicle's odometer analysis on January first and then once again at the end of the year. In in between, diligently track all your organization trips taking down the beginning and finishing readings. For each and every journey, record the place and service objective. This can be streamlined by keeping a driving log in your vehicle.

This includes the complete company mileage and overall gas mileage accumulation for the year (business + personal), journey's day, destination, and objective. It's necessary to tape activities immediately and preserve a simultaneous driving log outlining day, miles driven, and service function. Here's how you can boost record-keeping for audit functions: Start with making certain a meticulous gas mileage log for all business-related travel.

The Ultimate Guide To Mileagewise - Reconstructing Mileage Logs

The actual costs technique is an alternative to the conventional gas mileage rate technique. As opposed to computing your reduction based on a fixed price per mile, the actual costs method permits you to subtract the actual expenses linked with utilizing your lorry for company functions - mileage tracker app. These costs consist of fuel, upkeep, repair work, insurance coverage, depreciation, and other associated expenditures

Those with significant vehicle-related expenditures or one-of-a-kind problems might benefit from the actual expenditures method. Please note choosing S-corp condition can alter this computation. Eventually, your picked approach ought to line up with your certain economic objectives and tax circumstance. The Requirement Gas Mileage Price is a procedure issued annually visit our website by the internal revenue service to determine the insurance deductible expenses of operating a car for organization.

The 10-Minute Rule for Mileagewise - Reconstructing Mileage Logs

Keeping an eye on your mileage by hand can call for diligence, yet bear in mind, it might save you cash on your taxes. Adhere to these steps: Compose down the date of each drive. Tape-record the complete mileage driven. Consider noting your odometer analyses before and after each trip. Write down the starting and finishing points for your journey.

Indicators on Mileagewise - Reconstructing Mileage Logs You Should Know

In the 1980s, the airline industry became the very first business individuals of general practitioner. By the 2000s, the delivery sector had taken on general practitioners to track bundles. And currently virtually everybody utilizes general practitioners to get around. That indicates almost everyone can be tracked as they deal with their service. And there's the rub.

Comments on “See This Report about Mileagewise - Reconstructing Mileage Logs”